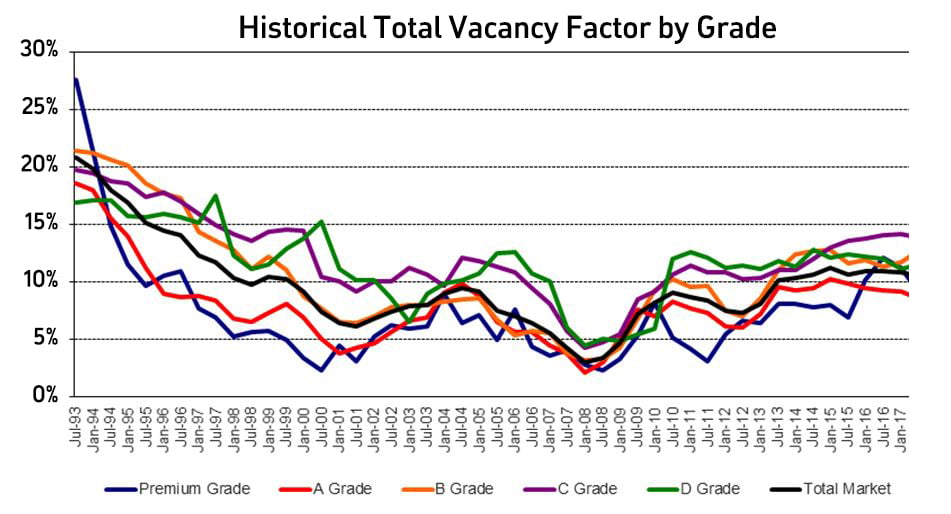

Every commercial office market in Australia shows a similar story when it comes to vacancy rates associated with buildings of a lower grade in quality. The Property Council of Australia’s office market reports consistently show that Premium and A Grade buildings have far lower vacancies than their B, C and D grade counterparts. The message is clear from the occupiers of these buildings. Commercial office tenants have demonstrated a preference for better quality accommodation every year and that trend shows no signs of abatement. Unfortunately, all buildings age and what was once an A grade building is eventually reclassified as a B and its desirability in the marketplace continues to wane until finally it is further downgraded resulting in an inevitable slide into obsolescence. That is unless it is retrofitted, refurbished and repositioned back to its former glory.

Timely for the South Australian marketplace with its historically high vacancy rates in lower quality buildings, new legislation was introduced into parliament in late 2016 and was enacted on the 1st August 2017 in an effort to provide a mechanism to assist building owners with the upgrade and repositioning of their assets. This legislation is called Building Upgrade Finance (BUF) and uses a financial instrument known as an environmental upgrade agreement (EUA). So while the BUF uses an environmental upgrade financing mechanism, known as an EUA (environmental upgrade agreement), the state government has reframed the conversation with a focus on upgrading buildings in general.

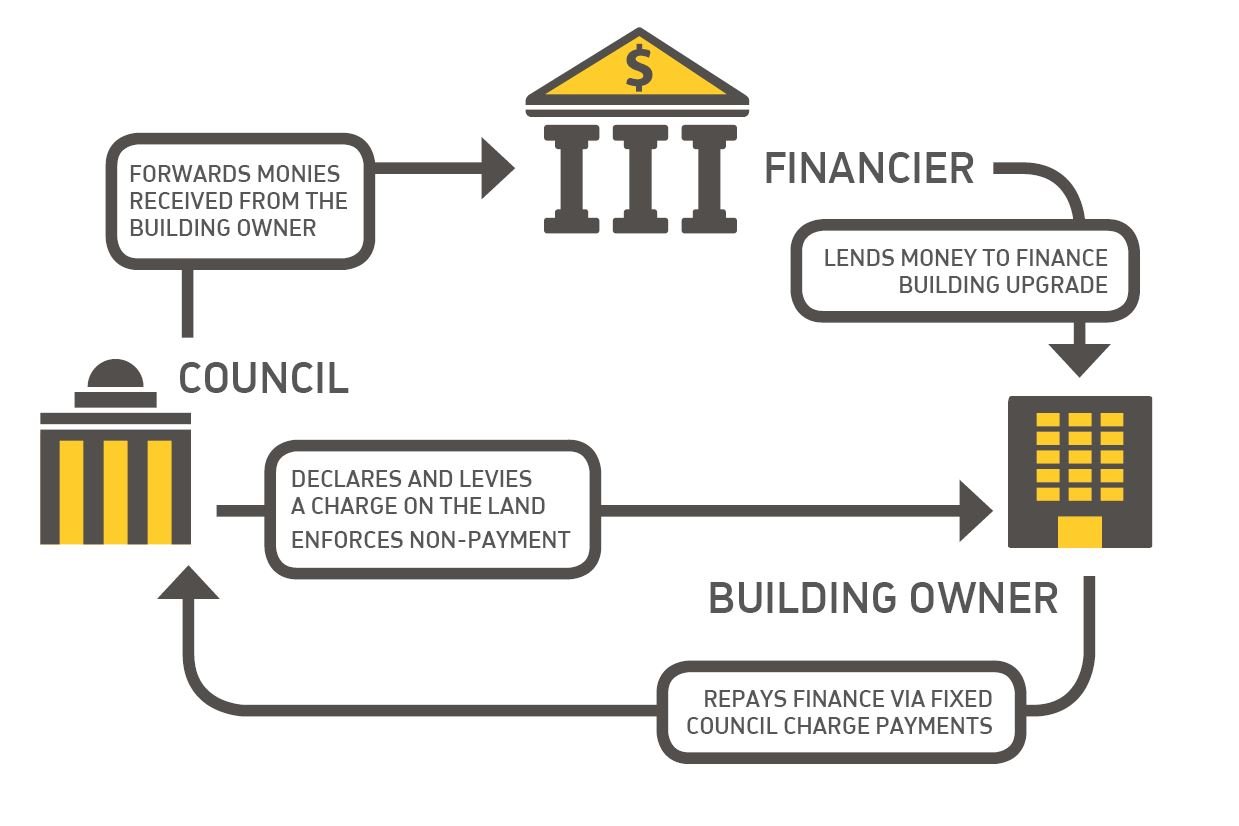

An EUA is a market-driven mechanism designed to make it easier to access finance for building upgrades that incorporate an environmental outcome (including energy efficiency improvements) for existing commercial, retail and industrial buildings. Under EUAs, a finance provider lends funds to a building owner for the building upgrade and this low-risk loan is repaid through a local council special charge on the land, similar to normal council rates. This special charge can then be levied against the tenant as part of their outgoings (provided that the charge is never greater than the amount of savings that are generated through the upgrade or unless otherwise agreed to by the tenant) and represents an additional income stream to be used to pay off the EUA debt. The mechanism, therefore, provides building owners with the opportunity of increasing cash-flow benefits whilst also accounting for necessary building expenditure.

One of the really powerful aspects of the BUF scheme is that it has the opportunity to be beneficial to both tenants and owners. It provides an opportunity for the building owner to upgrade their commercial property while also giving them a new revenue stream to pay down the debt for the upgrades. The benefits to tenants include improvements in productivity through enhanced access to natural light, more efficient and effective lighting, improved comfort conditions and the possibility of improved amenity through initiatives such as the addition of end of trip facilities. Additionally, the tenant will likely have a lower “whole of lease term” exposure due to the indexing of face rent only with the possibility of reducing outgoings (most likely over longer lease periods after BUF debt is paid off). All of these outcomes are fungible under the auspices of the BUF and will even support broader government policy initiatives including “Carbon Neutral Adelaide” here in South Australia.

The key to tapping into the benefits provided by an EUA, for building owners and their tenants, is their ability to be able to access the right expertise to quickly develop a deep understanding of any given building’s current operational limitations and therefore upgrade potential. There are plenty of internal and external environmental outcomes that can be achieved by going through a building upgrade of any description – it’s about working with the right designers to better understand how upgrades and improvements can reposition and add value to outdated office spaces. This is where Hames Sharley’s team of interior designers and architects come into play, where we are now designing with office space wellness and environmental standards in mind and identifying endless opportunities for improving, repositioning and rebranding commercial office spaces to be attractive to existing or future tenants and ultimately contributing to the vibrancy and commercial sustainability of the city.